What is journaling?

First and foremost, let's establish what journaling means in the context of trading. Journaling entails recording notes about your trading activities. It goes beyond technical aspects such as identifying the confluences that lead to a higher win rate or calculating your average RRR. It also involves documenting your emotional state of mind while trading.

Are you questioning the importance of journaling in trading? Do you wonder how it can benefit your trading and contribute to your profitability? Let me enlighten you. We assure you that you will be astonished by the significance of journaling as it was the number one thing that made us profitable traders. So, let's delve into it.

Why is it important to journal?

Journaling holds significant importance for several reasons. Firstly, it allows you to store crucial data, which is paramount in the world of trading. As we delve into this article, you will realize the profound impact it can have on your trading performance.

Every piece of data you record in your journal has the potential to refine your trading strategy and enhance your win rate or risk-to-reward ratio (RRR), ultimately leading to greater profitability. By documenting your emotions while entering or closing each trade, you gain a deeper understanding of your emotional tendencies. Additionally, journaling enables you to identify which confluences contribute to your success and which ones hinder your progress, among many other valuable insights.

Fully automated journal

While there are various approaches to journaling, you'll soon realize how tedious it can become when done manually over time. Instead, we highly recommend automating as many aspects as possible and manually recording only those details that cannot be recorded automatically.

In all honesty, it's unlikely that you'll come across a more exceptional automated journal than the one we offer on our website. Let's explore it together and discover how it can support you on your journey toward becoming a profitable trader.

What Billions Club journal involves?

Firstly, you can put your worries aside about whether your journaling method is correct. At Billions Club, we are a team of experienced traders who have designed a specialized trading journal that automatically captures all the crucial data necessary for your journey to profitability.

The first remarkable feature of our journal is its ability to capture every single one of your trades. When participating in our funding challenge, no trade can evade our algorithm, ensuring that you have accurate and comprehensive data on your trading performance. These data include:

Total P&L

This represents the overall outcome of your trading, indicating the amount of money you have either gained or lost during your trading period. As we mentioned earlier, our algorithm leaves no trade unaccounted for, making this a highly reliable measure of your trading performance.

Average winning trade

This section displays the average profit you have achieved when closing a winning trade. It plays a crucial role in calculating your average RRR, which is essential for determining the profitability of your trading plan. In the subsequent sections of this article, we will guide you on calculating your average Risk-to-Reward Ratio (RRR) and evaluating the profitability of your trading strategy.

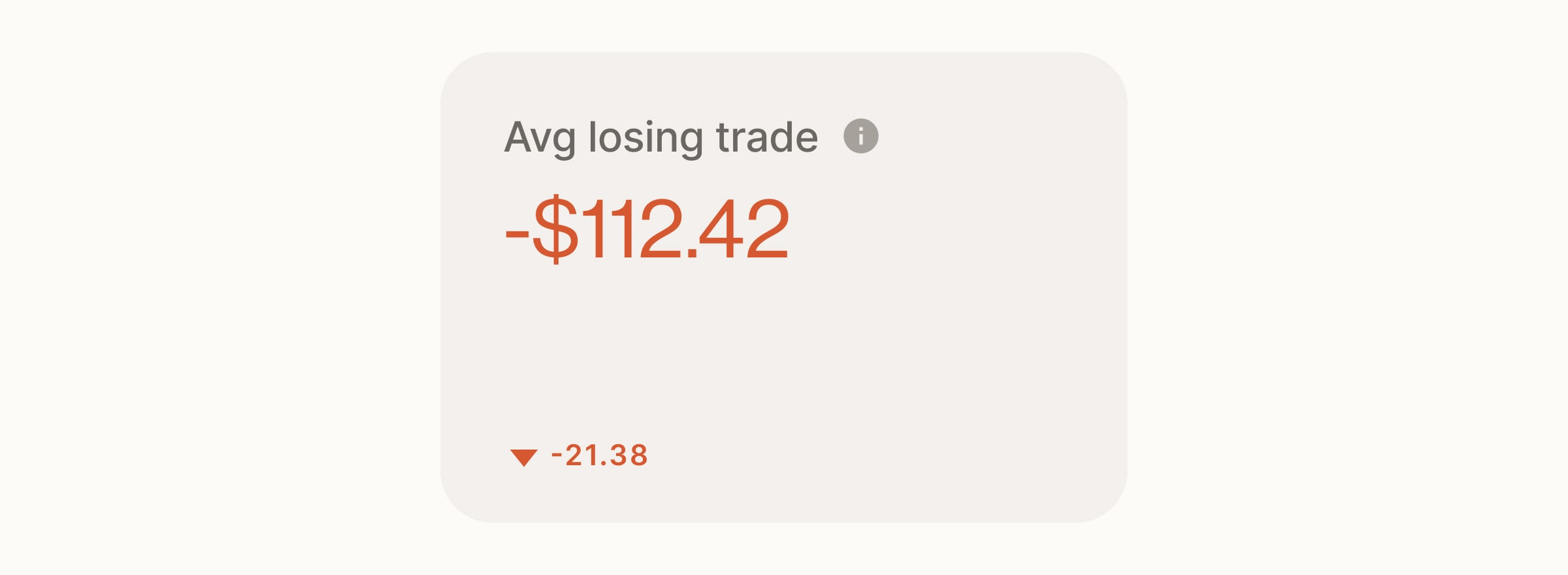

Average losing trade

In this section, you can see the average amount of money lost when closing a losing trade. With the data on both your average winning and losing trades, we can now proceed to the first critical step in assessing the profitability of your trading strategy: calculating your average RRR.

Calculating your average RRR

This process is actually quite straightforward yet immensely crucial. The calculation itself is simple. Take the value of your average winning trade and divide it by the value of your average losing trade. For example, if the outcome of the calculation is 3, it means your average RRR (risk-to-reward ratio) is 1:3. Remember this value as we continue through the article.

Winning % By Trades

This represents your win rate expressed as a percentage and is the second critical component in determining the profitability of your trading plan or strategy. The great thing is that you don't have to calculate this manually, as our trading journal will automatically compute it for you. Once we have these two values – average RRR and win rate – we can move forward to the determination that will reveal whether your trading plan is a winning one.

To assist with this determination, we will refer to the following table:

Daily Net Cumulative P&L

While this tool may be considered more visually appealing and less influential in determining the profitability of your trading strategy, it offers valuable insights into the consistency of your trading plan. Your goal should be to avoid significant fluctuations in your live trading or backtesting, as it is always emotionally easier to follow a trading plan that exhibits more consistent performance.

Calendar

In the Calendar section, you are presented with a clear overview of all the trades you have executed during your funding challenge or live trading journey. But we didn't stop there - we wanted to provide you with even more valuable insights. By simply clicking on any trade, you can access a wealth of information.

Not only do you have space to add additional notes about the trade you took, but you will also find detailed technical information. This includes crucial details such as the trade's direction (long or short), the specific instrument on which you entered the trade, the exact opening and closing times, as well as the corresponding opening and closing prices. With such comprehensive data at your fingertips, you can analyze and evaluate your trades with precision.

Proven Tips for Profitable Journaling: Insights from Our Trading Success

Now we will delve into our personal advice that has helped us, the traders at Billions Club, to achieve consistent profitability through journaling.

Recording your emotions

This is a part that many traders tend to overlook, but it holds significant importance in creating favorable conditions for your trading plan, ultimately leading to profitability. Towards the next part, I will share my personal example of how recording my emotions, along with technical notes about my trading, helped me establish a robust foundation for my trading plan. Today, this foundation plays a critical role in determining whether I will trade profitably or not.

How Journaling Can Tangibly Boost Your Win Rate: A Concrete Example

So, let's delve into the process itself. Imagine you're having a typical trading Monday. Suddenly, you enter a profitable trade with a risk-to-reward ratio (RRR) of 1:4, resulting in a 4% profit. It's an excellent trade. However, things take a turn when you encounter five consecutive losses, and the day ends in a loss. Without noting your emotions, your journal would only reflect the outcome of the day. Trust us, you won't remember how you felt after the profitable trade, how you felt after hitting the final stop loss, and so on. Allow us to demonstrate the value of including emotional notes in your journal.

Let's suppose that after the first profitable trade, you experience euphoria. We're all familiar with this state of mind; it often follows a successful trade. You start to believe you're invincible. The consequence of this emotional state is that you take two senseless losses driven by the belief that you're a trading genius after the big win. All of this is a crucial emotional process that should be documented in your notes. Then, you encounter three more losses. Why? Because you wanted to challenge the market and seek revenge for the previous losses. Once again, this is a significant psychological process that deserves to be captured in your notes.

Now, let's imagine you've written all of this in your journal. After two weeks, a similar situation arises. The same thing happens after one week. You then refer to your notes and realize, "Ah, I keep making the same mistakes and experiencing the same emotions repeatedly. What am I going to do about it?"

There are several ways to address this issue. As a group of traders who personally faced this problem, we can share our solution with you. Upon recognizing this pattern, we added a simple rule to our trading plans: When we achieve a significant winning trade and start feeling euphoric, we stop trading for that particular day and resume the next day. This approach helps protect our profits and enables us to maintain an objective and unemotional view of the market.

Confluence list

As you may already be aware, to become a profitable trader, you also need a well-defined trading plan with clearly specified conditions that you adhere to while trading. These conditions should include a list of confluences that must be met before entering a trade.

In practice, it usually looks like this: You have a list of around 3-5 conditions, and you require at least a few of them to be met before initiating a trade. When you do so, it's essential to document which confluences were present that led you to enter the trade.

Some traders not only include confluences in their trading plan but also have 3-4 entry patterns they use to enter trades. If you employ entry patterns, it's crucial to note in your journal which pattern served as the basis for your entry.

This information is significant for a simple reason. At the end of a series of trades, you should review your journal and analyze how these confluences have impacted your win rate and their effectiveness. This way, you can make adjustments to your trading plan, potentially removing some confluences and adding new ones, as well as modifying your entry patterns. Always strive to include confluences and entry patterns in your trading plan that offer the highest risk-to-reward ratio (RRR) and win rate possible.

Another valuable practice, in our opinion, is including images of your trade setups in your journal. Being able to visually observe your trades from multiple timeframes is always beneficial.

Maximizing Your Trading Plan through Statistical Analysis

Although journaling is an excellent method for progressing in your trading journey, it is not sufficient on its own. To maximize its positive impact, you need to extract statistical data from it to make the journaling process complete.

You can generate statistics from almost everything recorded in your journal. Allow us to provide you with some examples.

- Which days of the week does my trading plan yield the best results?

- Which combinations of confluences during trade entries lead to a higher win rate, and which ones result in a lower win rate?

- Which entry patterns are the most effective, and which ones should I avoid?

- Which currency pair offers the highest win rate or the greatest potential risk-to-reward ratio (RRR)?

- Which timeframes have a positive impact on my trading plan, and which ones do not?

- Do I achieve a higher win rate when using 5-minute (5M) entry patterns or 1-minute (1M) patterns?

And so on…

Guaranteed Profitability: Unlocking Success through Comprehensive Trading Journaling

There's absolutely no doubt that trading journaling will lead you to profitability. By implementing all the strategies outlined in this article, you'll witness tangible profits in your trading account before long.

We can personally vouch for this method, as it has played a pivotal role in our own journey toward becoming profitable traders. In fact, we, traders in Billions Club, consider it to be one of the two most critical components. The other crucial aspect—psychology—will be explored in future discussions.

Alright, let's begin our challenge to thoroughly analyze your trading performance using our automated journal and ultimately become a successful trader! Wishing you a wonderful day ahead!